Our Money Management Officer, Kassandra, was great to work with. I do not think she could do better.

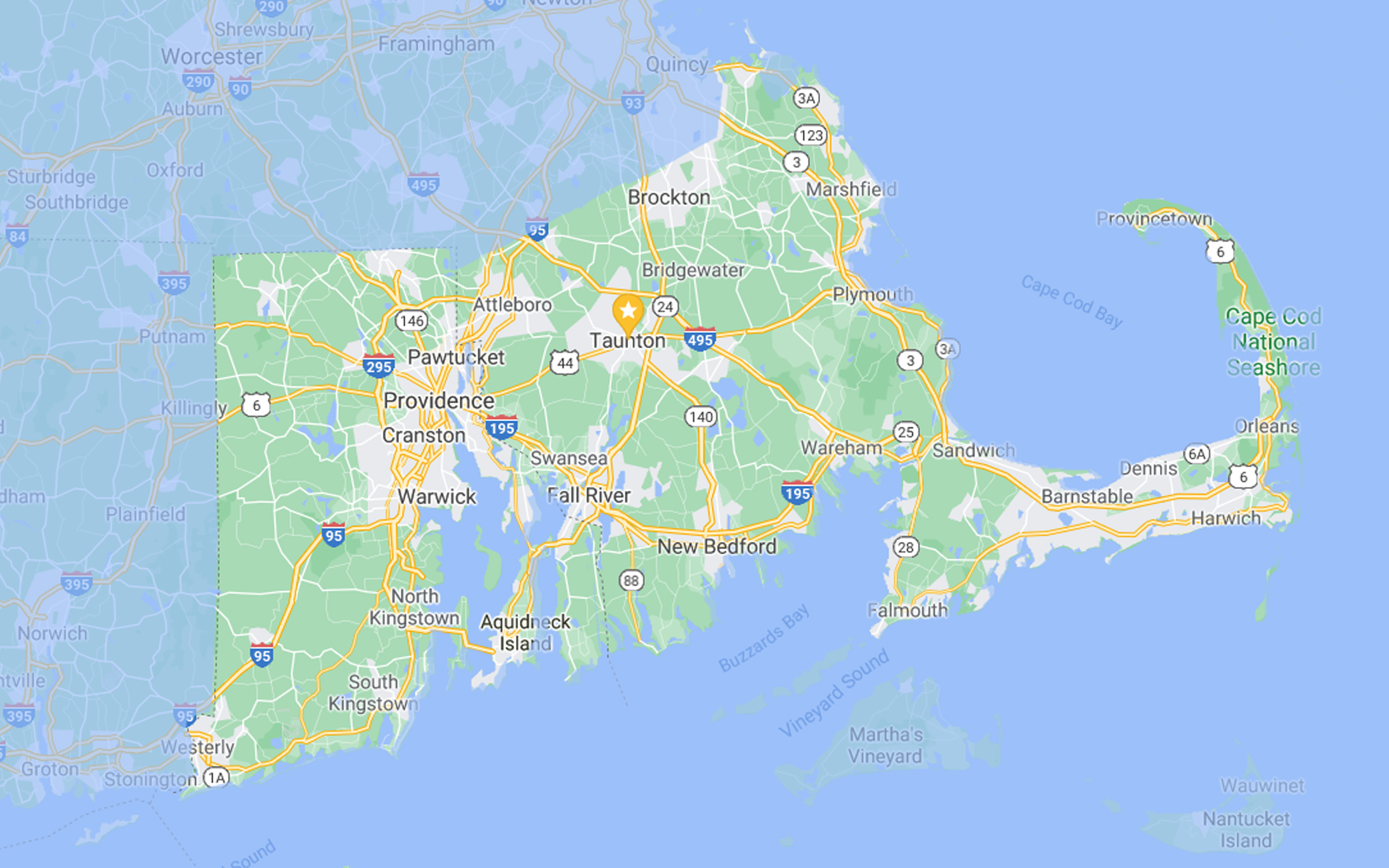

On the weekend of September 30th through October 2nd, we will be completing a Core System Conversion at our Somerset location, which will only affect our original SFCU members. Our Swansea branch and the former St. Dominic’s Federal Credit Union members will not be affected by this conversion.

Download the attached Member Resource Guide

Our core system is the key piece of software where we house all your loan and deposit accounts and where we transact all your business with SFCU. This system upgrade is an important technological advancement for the Credit Union and for you as it provides improved security, enhanced services, and greater banking convenience. Upgrading to a newer technology provides us with a stronger, more reliable, and more efficient system today as well as the ability to improve into the future with more capable applications, better information security and allow our membership to utilize the tools they need to achieve their own financial goals.

While most of the changes will happen behind the scenes, there will be some brief disruptions. We hope to work quickly and efficiently so this conversion is as seamless as possible for you. We would also like to apologize in advance for any inconveniences this may cause and thank you for your patience.

You will be receiving key information about our core conversion, including what accounts and services will be affected by email, social media, and this page of our website.

This conversion will be the first part of a two-part process. The second part of the conversion will be the migration of the former St. Dominic’s Federal Credit Union members and our Swansea branch core system, at a date to be determined in early 2024.

If you have any questions, please don’t hesitate to contact us at 508-678-2851.