I have been a member for a very long time. I am always satisfied with whatever I need to do at the Credit Union. The staff is always accommodating and courteous. The hours of operation are also very convenient.

FAQs

Membership FAQs

Visit our office at 740 County Street in Somerset, MA. You will need to provide a picture ID such as an unexpired driver’s license to qualify for membership. You qualify for membership if you or a member of your immediate family lives, works, worships or attends school in Bristol County, Plymouth County & Barnstable County in Massachusetts; Bristol, Kent, Newport and Providence counties in Rhode Island; and the Rhode Island towns of Charlestown, Exeter, Hopkinton, Narragansett, New Shoreham, North Kingstown, Richmond and South Kingstown.

We offer a variety of accounts for all ages. Please contact us at 508-678-2851, option #4. We are happy to help you find the best account to meet your needs.

Mortgage FAQs

Absolutely! Everyone’s situation is unique, so stop in or call. Our Loan Officers are always available to meet with you to discuss your options. There is no obligation and this service is FREE.

You may apply for a loan with SFCU if you qualify for membership. You qualify for membership if you, or a member of your immediate family, lives or works in Bristol County, Massachusetts.

The property financed must be located in Massachusetts.

SFCU finances the following types of property:

You may apply online or you may stop by our office at 740 County Street, Somerset, MA. Our Loan Officers are always available to meet with you. No appointment is needed.

Please View our Documentation Checklist or call one of our Loan Officers directly.

A pre-qualification is a lender’s estimate of how much you could be eligible to borrow based on information you supply such as gross monthly income, your monthly expenses such as payments for car loans, student loans, credit cards and other loans (utilities and rent are not included). Pre-qualification does not mean you will get the loan. It helps you shop for a home you can afford.

Pre-approval means that a lender is ready to offer financing based on the information and documentation you provide. A pre-approval is valid for a certain length of time and may contain other conditions. The only fees you incur for a pre-approval is the cost of your credit report.

What’s best for you really depends on what you’re trying to accomplish. Everyone’s situation is unique, so stop in or call. Our Loan Officers are always available to meet with you to discuss your options. There is no obligation and this service is FREE.

This insurance, paid by the homeowner, covers the lender in the event that the homeowner defaults on the mortgage.

While an expense, PMI does enable those who have accumulated as little as 5% for a down payment to purchase a home sooner rather than later. PMI premiums are paid monthly as part of your mortgage payment. Also, once you have paid down your mortgage to 80% of the purchase price, you have the right to cancel the coverage. (You must be current on your mortgage, with no second mortgage, and any appreciated home value does not factor into the 80% amount.)

In general, you’ll need at least 5% down with private mortgage insurance (PMI) and 20% down without it. A down payment could consist of funds you have saved, a gift from an immediate family member or through one of many grants offered to first time homebuyers. You can choose to pay PMI monthly or in a lump sum. We can also work with you to pay down the principal in order to eliminate PMI quicker. Because individual situations vary, we suggest you meet with one of our Loan Officers who can tell you exactly what you need for a down payment based on your unique situation.

Yes, it’s very possible. The documentation needed is the same needed for a conventional purchase. With your income and expense documents supplied to us, a Loan Officer can meet with you to explore the financing options.

Documentation showing your closing costs are provided to you within three business days of receiving your completed mortgage application.

Direct Deposit FAQs

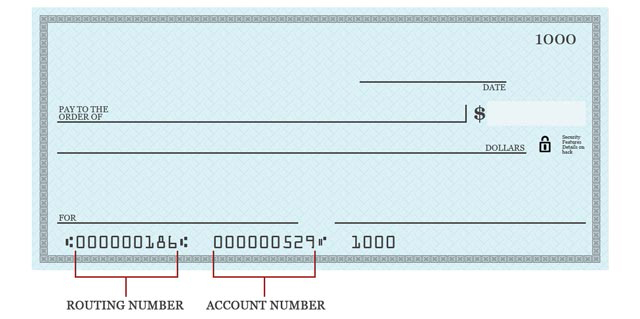

You need to provide three pieces of information to your employer, government agency or other pay provider.

All the information you need is right on your Somerset Federal Credit Union check.

If you have a statement savings, please look at the membership card you were given at account opening. If you cannot find what you need, please stop by our office. We will be happy to help you!

To avoid overdraft fees or transaction limits you should direct deposit your funds into your SFCU checking account. You can transfer funds to your statement savings online or via TELLERphone.

If you do not have a SFCU checking account, then direct deposit the funds into your statement savings account or open a checking account today. It is fast and easy to do!

The U.S. Treasury Department requires federal benefit payments (such as Social Security and VA payments) to be made electronically. Sign up for direct deposit at GoDirect.org by submitting your benefit check information plus our routing number: 211385572.

eStatement FAQs

eStatements are an electronic version of your monthly SFCU statement. eStatements offer you a convenient way to view, print and download your account statements right from your computer.

eStatements are:

You may receive eStatements for checking accounts, Statement Savings accounts, loan billing notices and other loan notices, such as maturity notices and past due notices.

You may contact a Credit Union representative who can enroll you. You can also enroll by following these easy steps:

- Sign into Online Banking.

- Select ‘Profile’ located at the top right-hand corner of the page.

- Select the ‘Edit’ icon for Electronic Statements.

- Select the accounts you wish to enroll for eStatements.

- Click on ‘Terms & Conditions.’

- Click ‘Save.’

Once you receive the email notification, simply visit the SFCU website at www.somersetfcu.com and log into Online Banking. From the home page, select the account you want to view. When the account page opens, select ‘Documents,’ then select the statement or notice you want to view.

You need Adobe Acrobat Reader version 6.0 or higher to view your eStatements.

Please call us at 508-678-2851, option #3.

We began offering a new version of eStatements in June of 2017. These will be available online for 30 months. If you need statement copies prior to June of 2017, please call us at 508-678-2851 and select option #3.

SFCU will not send paper statements once you enroll in eStatements.

Log into SFCU Online Banking and select ‘Profile’ in the upper right hand corner to update your email address.

Online Services FAQs

Once enrolled in Online Banking, you can view all accounts tied to your Social Security Number. Online transactions are permitted on checking, statement savings and loan accounts.

Enroll by entering some basic personal and account information. It only takes a few minutes. You will need:

Download the SFCU app from Google Play (Android) or the iTunes Store (Apple). Enter your online banking login credentials (User Name and Password).

Mobile Deposit Capture is a feature of SFCU Mobile Banking. Once you download the app and enroll in Mobile Banking, simply click on the ‘Deposit’ icon at the bottom of the screen.

Once you enroll in Online Banking, click the link that reads ‘Accounts Available for Bill Pay.’

We offer online loan applications but we do not open checking or savings accounts online at this time.

Yes, you can apply for a personal loan or a mortgage online.

The SFCU mobile app does not offer alerts at this time.

Mobile Banking FAQs

Download the SFCU app from Google Play (Android) or the iTunes Store (Apple). Enter your Online Banking login credentials (User Name and Password).

Mobile Banking has been designed to work with your tablet as well as your smartphone.

Mobile Deposit Capture is a feature of SFCU Mobile Banking. Once you download the app and enroll in Mobile Banking, simply click on the ‘Deposit’ icon at the bottom of the screen.

You should endorse the check as follows: “For Mobile Deposit Only” or check the box that states “Mobile Deposit.”

Bill Pay FAQs

Provide some info about the company or person you want to pay, and then tell us how much and when you want the payment made. We send your payment electronically when possible. If the person or company can’t accept electronic payments, we print a check and mail it for you. The Payment Center lists the companies and people you can pay. Enter a payment amount and the date when you want processing to begin. The date when the company or person receives the payment appears in the Deliver By field. You can also view and select the date from the calendar.

Pay anyone in the United States that you would normally pay by check, automatic debit, or cash. You can pay companies, friends and family members, and service providers, such as the babysitter or the plumber.

Yes. SFCU Bill Pay uses several methods to ensure that your info is secure.

Yes. Your personal info is used to help us maintain your account and verify your identity. We verify this info with a consumer credit reporting agency for your security and protection. The verification process does not affect your credit report, credit rating, or credit worthiness. Please review the Terms of Service for a complete description of when SFCU Bill Pay must disclose info to third parties.

Yes. SFCU Bill Pay follows the World Wide Web Consortium’s Web Content Accessibility Guidelines (WCAG) 2.0 Level AA recommendations. The following features aim to make SFCU Bill Pay more accessible to assistive technology users:

We will make that change for you! Call us at 508-678-2851, option #3.

St. Dominic’s FAQs

This merger makes both of our organizations stronger, which benefits our members, our employees and the communities we serve. Partnering with another established credit union will significantly increase operating efficiencies so that we have the resources to deliver much more to St. Dominic’s Federal Credit Union members—with the same personalized service we have always provided.

This merger will provide the resources to better serve your financial needs through an added branch and ATMs, well developed online and mobile technologies, new products and services, and highly competitive rates.

SFCU is headquartered in Somerset, MA. Its birth took place in 1936 at Panneton’s Drug Store. The community of farmers and working people came together and founded Somerset’s first financial institution, the “Somerset Community Credit Union.” Since banks of the day would lend only to property owners, the new credit union expanded access by loaning money to people based on their good character and proof of steady employment. The financial institution was later renamed “Somerset Federal Credit Union,” and was one of the first credit unions in Massachusetts to own and operate its own building at 1275 County Street.

Now headquartered at 740 County Street in Somerset, SFCU is proud to have more than 12,000 members and over $202 million in assets. Under the leadership of a member elected board of directors, and dedicated senior management team, SFCU continues to look towards the future by providing banking solutions for each generation we serve.

Both credit unions performed their due diligence while obtaining regulatory approval from the National Credit Union Administration (NCUA). Once regulatory approval was received, a special meeting took place on Tuesday, November 1st at St. Dominic’s Federal Credit Union.

St. Dominic’s Federal Credit Union team members will retain employment and nearly everyone will maintain the same or similar role. In fact, a merger creates a tremendous amount of opportunity for existing employees to expand their career options in the future. SFCU team members will also retain employment.

No. There is no overlap between the St. Dominic’s Federal Credit Union and SFCU branch network. The current St. Dominic’s Federal Credit Union, located at 1723 GAR Highway, Swansea, MA, will remain open, and you will continue to receive the same personalized service you do today. However at this time, members can only transact business at the location where their specific account was opened.

We will not change our hours of operation. In the event there are changes in the future, our members will receive ample notice.

We want to ensure our members that your funds are safe. Both St. Dominic’s Federal Credit Union and SFCU are federally insured by the National Credit Union Administration (NCUA).

No. At this time, your member and account numbers will remain the same. In the event that your member or account numbers have to change in the future, you will be notified well in advance, and we will assist you every step of the way.

At this time, there will be no changes to your online and mobile banking login credentials. Until further notice, please continue using your current username and password to access your online banking.

At this time, there will be no changes to your online account access. Please log in as usual to view account history and download eStatements.

Again, at this time, it is business as usual, and everything will continue to work as it has. We are committed to make any transition as seamless as possible so you will continue to enjoy uninterrupted access to your money.

Yes, because routing and member numbers are remaining the same, you may continue to use your current checks.

You will continue to use ATMs as you do today. In addition, SFCU has partnership with Allpoint® and you will now have access to over 55,000 ATMs nationwide. Please keep in mind all ATM monetary deposits need to be made at the location that specific account was opened in.

Yes. You will continue to use your St. Dominic’s Federal Credit Union debit card as you do today. In addition, St. Dominic’s Federal Credit Union debit cards can be used at either location surcharge free.

At this time, members can only transact business at the location where their specific account was opened.

Our collective commitment to the communities we’ve served remains steadfast, and we look forward to the potential of even more significant and broader participation with the financial strength of the combined organizations.

At this time, no action is needed.

The President/CEO of the merged credit union is Joseph Lajoie.

As more information becomes available, please visit www.somersetfcu.com for details. You are also welcome to visit the Somerset Federal Credit Union branch or speak to our member service representative by calling 508-678-2851.

CardHub FAQs

CardHub is a next generation digital solution that integrates directly with the SomersetFCU Mobile banking application to deliver connected digital-first payment experiences to members. CardHub offers a multitude of card management functions that creates control, convenience and transparency.

Key features include:

- Card controls and alerts.

- Push provisioning to digital wallets (Apple Pay®, Google Pay™).

- Self-service features.

- Spend insights and enriched transaction details.

CardHub is designed to be integrated into the SomersetFCU Mobile banking app to provide a seamless digital experience. Therefore, it’s easy to access. Once you are in the SomersetFCU Mobile banking app, click “My Cards” to access all the features of CardHub, from within the same app.

No, CardHub is integrated right into the SomersetFCU mobile banking app, so no additional app is necessary. Once you are in the SomersetFCU Mobile banking app, click “My Cards” to access all the features, from within the same app.

CardHub will allow you to:

- Manage cards on-the-go with advanced controls and self-service options.

- Understand spending clearly with quick spending insights, recurring/card-on-file merchant identification and transactions enriched with clear merchant names, logos, interactive maps, and contact information.

- Engage in real time with transaction alerts.

- View a digital card on a mobile device and easily push it to Apple Pay® and Google Pay™.

If your SFCU Visa® Debit Card is not already loaded to CardHub, log into the SomersetFCU Mobile app and click “My Cards”. The app will then ask you to enter your card number to begin and complete the registration process.

Yes. You can link all of your eligible SFCU Visa® Debit Cards, and even all the cards of your authorized users, to turn each card on or off, set controls and get alerts for each card independently of one another. After adding your first card you can add additional cards. Swipe the image of your card to the left and you’ll see a new default card image with a plus sign and the words Add Card. Tap the plus sign to add another card.

There is a Card On/Off switch right below the image of your card. It will be green and switched to the right when your card is on. To turn it off, swipe the switch to the left.

To set up controls for card purchases, swipe to the desired card image and tap Control Preferences. You will see the option to set up controls based on location, merchant type, transaction type or spend limit. Tap on a control category to set up purchase restrictions as desired.

To set up alerts for card purchases, swipe to the desired card image and tap Alert Preferences. The send alerts for drop-down will be defaulted to All Transactions, or you can select Selected Transactions to set up specific alerts based on location, merchant type, transaction type or spend limit. Tap on an Alerts category to set up Alerts as desired.

To receive any alerts, you need to have notifications for the app turned on. Go to the settings on your phone, find SomersetFCU Mobile and ensure notifications are turned on.

To review transactions, swipe to the desired card image and tap Transactions. You will then see the list of all your recent card transactions. Tap on a specific transaction to view more details. Transactions will show from the time your card(s) are added to the app.

Only purchases made with your card/card number will appear. For example, if you write a check or have an automatic online payment set up through your account (not card) number, these transactions will NOT show.

No, you do not need to do anything if you received a new card because your old card expired. Since your card number is the same, it will remain in the app and will automatically update your card expiration date.

Yes, you need to add your new card with the new card number.

If you ever get an alert for a transaction that you did not make or authorize, contact SFCU right away at 508-678-2851, option #3.

For assistance, please call 508-678-2851, option #3, Monday – Wednesday from 9:00 AM – 4:00 PM, Thursday and Friday from 9:00 AM to 6:00 PM and Saturday from 9:00 AM – 12:00 PM.

Reverse Christmas Club Loan FAQs

A Reverse Christmas Club Loan is a short-term loan designed to help our members pay for holiday expenses without using a high interest credit card.

You can borrow up to $2,500 with a Reverse Christmas Club Loan.

The term on our Reverse Christmas Club Loan is 12 months.

The annual percentage rate on a Reverse Christmas Club Loan is 2.99%.

Your monthly payment would be determined by the amount you borrow. Here are some examples (this is an illustration only):

| Amount Borrowed | Estimated Monthly Payment Based on Annual Percentage Rate of 2.99% |

|---|---|

| $500 | $42.34 per month |

| $1,000 | $84.69 per month |

| $1,500 | $127.03 per month |

| $2,000 | $169.38 per month |

| $2,500 | $211.72 per month |

Zelle® FAQs

You can send, request or receive money with Zelle®.

- To start using Zelle® at Somerset Federal Credit Union, you must be enrolled in Bill Pay. If you are not already enrolled in Bill Pay, you can enroll by logging in to Online Banking or our mobile banking app. Locate the Tab Name tab and follow the instructions to complete the Bill Pay enrollment steps. Once enrolled in Bill Pay, you can access “Send Money With Zelle®” tab in Bill Pay to complete a brief one-time enrollment to tell us which email address or U.S. mobile number and deposit account you would like to use to send and receive money with Zelle®.

- To send money using Zelle®, simply add a trusted recipient’s email address or U.S. mobile phone number, enter the amount you’d like to send and an optional note, review, then hit “Send.” In most cases, the money is available to your recipient in minutes if they are already enrolled with Zelle®.

- To request money using Zelle®, choose “Request,” select the individual from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request.” If the person you are requesting money from is not yet enrolled with Zelle®, you must use their email address to request money. If the person has enrolled their U.S. mobile number, then you can send the request using their mobile number.

- To receive money, just share your enrolled email address or U.S. mobile number with a friend and ask them to send you money with Zelle®. If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your account, typically within minutes.

If you have already enrolled with Zelle®, you do not need to take any further action. The money will be sent directly into your bank account and will be available typically within minutes.

If you have not yet enrolled with Zelle®, follow these steps:

- Click on the link provided in the payment notification you received via email or text message.

- Select Somerset Federal Credit Union.

- Follow the instructions provided on the page to enroll and receive your payment. Pay attention to the email address or U.S. mobile number where you received the payment notification — you should enroll with Zelle®using that email address or U.S. mobile number where you received the notification to ensure you receive your money.

Your email address or U.S. mobile phone number may already be enrolled with Zelle® at another bank or credit union. Call our member support team at 508-678-2851 and ask them to move your email address or U.S. mobile phone number to Somerset Federal Credit Union so you can use it for Zelle®.

Once member support moves your email address or U.S. mobile phone number, it will be connected to your Somerset Federal Credit Union account so you can start sending and receiving money with Zelle® through the Somerset Federal Credit Union mobile banking app and online banking. Please call Somerset Federal Credit Union’s member support toll-free at 508-678-2851 for help.

Keeping your money and information safe is a top priority for Somerset Federal Credit Union. When you use Zelle® within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe.

Zelle® is a great way to send money to family, friends and people you are familiar with such as your personal trainer, babysitter or neighbor.1

Since money is sent directly from your bank account to another person’s bank account within minutes,1 Zelle® should only be used to send money to friends, family and others you trust.

If you don’t know the person or aren’t sure you will get what you paid for (for example, items bought from an online bidding or sales site), you should not use Zelle®. These transactions are potentially high risk (just like sending cash to a person you don’t know is high risk).

Neither Somerset Federal Credit Union nor Zelle® offers a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for or the item is not as described or as you expected.

You can find a full list of participating banks and credit unions live with Zelle® here.

If your recipient’s financial institution isn’t on the list, don’t worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number and a Visa® or Mastercard® debit card with a U.S. based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

To use Zelle®, the sender and recipient’s bank accounts must be based in the U.S.

You can only cancel a payment if the person you sent money to hasn’t yet enrolled with Zelle®. To check whether the payment is still pending because the recipient hasn’t yet enrolled, you can go to your activity page, choose the payment you want to cancel and then select “Cancel This Payment.”

If the person you sent money to has already enrolled with Zelle®, the money is sent directly to their bank account and cannot be canceled. This is why it’s important to only send money to people you know and trust, and always ensure you’ve used the correct email address or U.S. mobile number when sending money.

If you sent money to the wrong person, please immediately call member services at 508-678-2851 so we can help you.

We offer you the flexibility to schedule payments to be sent at a later date if you like, or even set up recurring payments for things like regularly sending money to your college student.

Scheduled or recurring payments sent directly to your recipient’s account number (instead of an email address or mobile number) are made available by Somerset Federal Credit Union but are a separate service from Zelle® and can take one to three business days to process. You can cancel a payment that is scheduled in advance if the money has not already been deducted from your account.

Somerset Federal Credit Union does not charge fees to send or receive money with Zelle®, but there is a fee to cancel a Zelle® transaction that is still pending because the recipient hasn’t yet enrolled. If the recipient doesn’t enroll with Zelle® within 14 days, the payment will naturally expire, the funds will be returned to your account and no fees will be assessed.

Your mobile carrier’s messaging and data rates may apply.

The amount of money you can send, as well as the frequency, is set by each participating financial institution. To determine Somerset Federal Credit Union send limits, call our member service at 508-678-2851.

There are no limits to the amount of money you can receive with Zelle®. However, remember that the person sending you money will most likely have limits set by their own financial institution on the amount of money they can send you.

1U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution’s online or mobile banking experience.

Data charges may apply. Check with your mobile phone carrier for details. App Store is a service mark of Apple Inc. Apple and the Apple logo are trademarks of Apple Inc, registered in the U.S. and other countries. Android, Google Play and the Google Play logo are trademarks of Google Inc.

Copyright © 2023 Somerset Federal Credit Union. All rights reserved. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Our Money Management Officer, Kassandra, was great to work with. I do not think she could do better.

Arlene Fortin has always been an absolute pleasure to work with.

Our friend mentioned how great SFCU was to work with. The staff makes you feel welcome. Working with the mortgage team was great and very helpful.